In the world of business, financial management is key.

Understanding the difference between bookkeeping and accounting is crucial.

Bookkeeping and accounting are two distinct functions. Both are essential for maintaining financial health and compliance.

Yet, many people use these terms interchangeably. This can lead to confusion, especially when seeking professional services.

In this article, we will demystify the difference between bookkeeping and accounting. We aim to provide clarity on their unique roles and responsibilities.

Whether you’re a business owner, a finance student, or simply curious, this guide will offer valuable insights. Let’s delve into the world of bookkeeping vs accounting.

Understanding the Basics

Before we delve into the differences, let’s define the basics.

Bookkeeping and accounting are two sides of the same coin. They both deal with financial data, but in different ways.

Here’s a simple comparison:

- Bookkeeping: The process of recording daily financial transactions.

- Accounting: The process of interpreting, classifying, analyzing, reporting, and summarizing financial data.

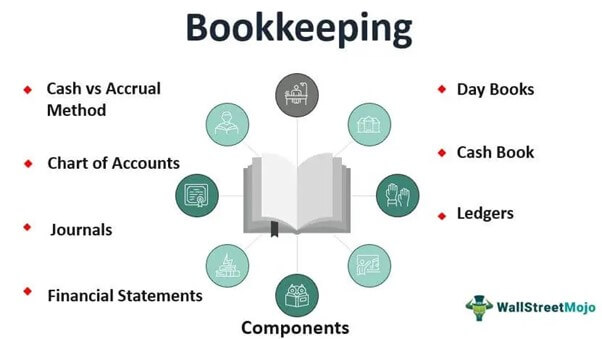

What is Bookkeeping?

Bookkeeping is the first step in the accounting process.

It involves the systematic recording of financial transactions. This includes sales, purchases, income, and payments.

The goal of bookkeeping is to keep accurate records of these transactions.

What is Accounting?

Accounting, on the other hand, is more analytical.

It involves interpreting, classifying, and summarizing financial data. Accountants use this data to produce financial reports.

These reports help stakeholders make informed business decisions. Accounting also involves strategic tax planning and advice.

Key Roles and Responsibilities

Both bookkeepers and accountants play crucial roles in a business’s financial management.

However, their responsibilities differ significantly.

Let’s break down the key roles of each.

The Role of a Bookkeeper

A bookkeeper’s role is primarily transactional and administrative.

Their responsibilities often include:

- Managing the general ledger

- Processing invoices

- Reconciling accounts

Bookkeepers ensure that all financial transactions are recorded accurately and timely.

They provide the raw data that accountants need to analyze the financial health of a business.

The Role of an Accountant

Accountants, on the other hand, are more analytical.

Their responsibilities often include:

- Preparing income statements, balance sheets, and cash flow statements

- Providing financial forecasts and business advice

- Strategic tax planning and advice

Accountants interpret the data provided by bookkeepers to assess the financial position of a business.

They also help stakeholders understand the financial implications of business decisions.

Educational Requirements and Certifications

The educational requirements for bookkeepers and accountants differ due to the complexity of their roles.

Let’s delve into the specifics.

For Bookkeepers

Bookkeeping does not require a formal education.

However, a basic understanding of financial principles and proficiency in bookkeeping software is often necessary.

Some bookkeepers may choose to earn certification, such as the Certified Bookkeeper designation, to enhance their credibility.

For Accountants

Accounting, on the other hand, requires a higher level of education.

Most accountants hold a bachelor’s degree in accounting or a related field.

Many also pursue advanced certifications, such as becoming a Certified Public Accountant (CPA), to demonstrate their expertise and commitment to the profession.

The Interplay Between Bookkeeping and Accounting

Bookkeeping and accounting are two sides of the same coin.

They work together to ensure the financial health of a business.

Bookkeeping, being the first step, involves recording all financial transactions. This data forms the basis for the work of accountants.

Accountants take this data and use it to generate financial reports. These reports provide insights into the financial status and performance of the business.

In essence, bookkeeping lays the groundwork for accounting. Without accurate bookkeeping, accountants would not have reliable data to work with. Conversely, without accounting, businesses would not be able to understand and utilize the data recorded by bookkeepers.

When to Hire a Bookkeeper vs. an Accountant

Understanding when to hire a bookkeeper or an accountant can be crucial for your business.

The decision largely depends on the complexity of your financial transactions and the stage of your business.

For startups and small businesses with relatively simple transactions, a bookkeeper may suffice. They can handle daily financial tasks such as recording transactions, managing invoices, and reconciling accounts.

As your business grows and financial transactions become more complex, you may need the expertise of an accountant. Accountants can provide valuable insights into your business’s financial health, help with tax planning, and assist in making strategic business decisions.

Here are some scenarios when you might consider hiring a bookkeeper or an accountant:

- Hire a Bookkeeper when:

- You need someone to handle daily financial tasks.

- Your business transactions are relatively simple.

- You need help with managing invoices and accounts.

- Hire an Accountant when:

- Your business transactions are complex.

- You need help with tax planning and compliance.

- You need financial advice for business growth and strategic planning.

The Impact of Technology on Bookkeeping and Accounting

Technology has significantly transformed the fields of bookkeeping and accounting.

Automation and cloud-based software have streamlined many traditional tasks. This has made financial management more efficient and accurate.

For bookkeepers, software tools can automate tasks such as data entry and invoice processing. This allows them to focus more on ensuring the accuracy of financial records.

Accountants, on the other hand, can leverage technology for complex tasks. These include financial analysis, forecasting, and strategic planning. Advanced software can provide real-time financial data and insights, aiding in informed decision-making.

In conclusion, technology has not only simplified bookkeeping and accounting tasks. It has also enhanced the roles of bookkeepers and accountants, enabling them to provide more value to businesses.

Choosing the Right Accounting Services for Your Business

Choosing the right accounting services for your business is a crucial decision. It can significantly impact your financial management and overall business success.

Firstly, you need to understand your business’s specific needs. Are you looking for basic bookkeeping services, or do you require more advanced accounting expertise?

For small businesses with straightforward transactions, a bookkeeper may suffice. They can manage daily financial transactions and maintain accurate records.

However, as your business grows and transactions become more complex, you may need an accountant. Accountants can provide strategic financial advice, tax planning, and financial analysis. They can also prepare financial statements and ensure compliance with financial regulations.

Here are some factors to consider when choosing accounting services:

- Your business size and industry

- The complexity of your financial transactions

- Your budget for accounting services

- The specific financial skills and expertise required

- The reputation and credentials of the accounting service provider

In conclusion, choosing the right accounting services requires careful consideration. It’s about finding the right balance between your business needs and the cost of the services.

Conclusion: The Synergy of Bookkeeping and Accounting in Financial Management

In conclusion, both bookkeeping and accounting play vital roles in financial management. They work together to ensure the financial health and success of a business.

Bookkeeping lays the groundwork by recording and organizing financial transactions. It provides the raw data that accounting uses to analyze and interpret financial information. This analysis aids in strategic decision-making and future planning.

Understanding the difference between bookkeeping and accounting is crucial for business owners. It helps in choosing the right financial services, ensuring compliance, and making informed business decisions.

FAQs About Bookkeeping and Accounting

To wrap up, let’s address some frequently asked questions about bookkeeping and accounting. These questions often arise when individuals or businesses are considering their financial management needs.

- Is bookkeeping easier than accounting? Bookkeeping is generally less complex as it involves recording and organizing financial transactions. Accounting, on the other hand, involves more complex tasks like financial analysis and strategic planning.

- Can a bookkeeper do an accountant’s job? While some tasks may overlap, an accountant’s role typically requires more specialized knowledge and skills, especially for tasks like tax planning and financial forecasting.

- Do I need both a bookkeeper and an accountant for my business? The answer depends on your business’s size, complexity, and specific needs. Small businesses may start with bookkeeping services and later engage accountants as they grow and their financial management needs become more complex.

Remember, understanding the difference between bookkeeping and accounting can help you make informed decisions about your business’s financial management.